Health Insurance in Florida: Tips for Lowering Your Premiums and Deductibles

Health Insurance in Florida: Tips for Lowering Your Premiums and Deductibles

Blog Article

Discover the Right Medical Insurance Strategy to Fit Your Needs and Spending Plan

Browsing the complexities of health and wellness insurance can be a challenging task, particularly when attempting to align your particular wellness requires with your economic constraints. A thorough understanding of your medical history, lifestyle, and possible future health needs is vital in establishing one of the most ideal coverage. In addition, reviewing numerous plans includes not only the sorts of services covered yet likewise a careful contrast of costs, including premiums and out-of-pocket expenditures. As you think about these vital aspects, the question remains: just how can you make sure that your chosen plan adapts to your evolving wellness landscape?

Understand Your Health Demands

Recognizing your health and wellness needs is a crucial step in picking the ideal health and wellness insurance coverage strategy. An accurate assessment of your health scenario assists in determining which prepare will ideal serve your demands, making certain economic security and access to needed solutions.

Following, assess the frequency of your medical professional check outs and any kind of awaited medical care needs, such as prescription drugs or expert assessments. If you have dependents, consider their wellness profiles too. It's likewise important to make up potential changes in your health, such as organized maternity or aging-related problems, which might influence your demands over time.

Lastly, analyze your way of life factors, including exercise practices, nutrition, and anxiety levels, which might influence your general health. By completely recognizing your health and wellness requires, you can make educated choices that align with both your current circumstance and future expectations, leading the way for a suitable medical insurance plan that offers ideal insurance coverage and satisfaction.

Evaluate Coverage Options

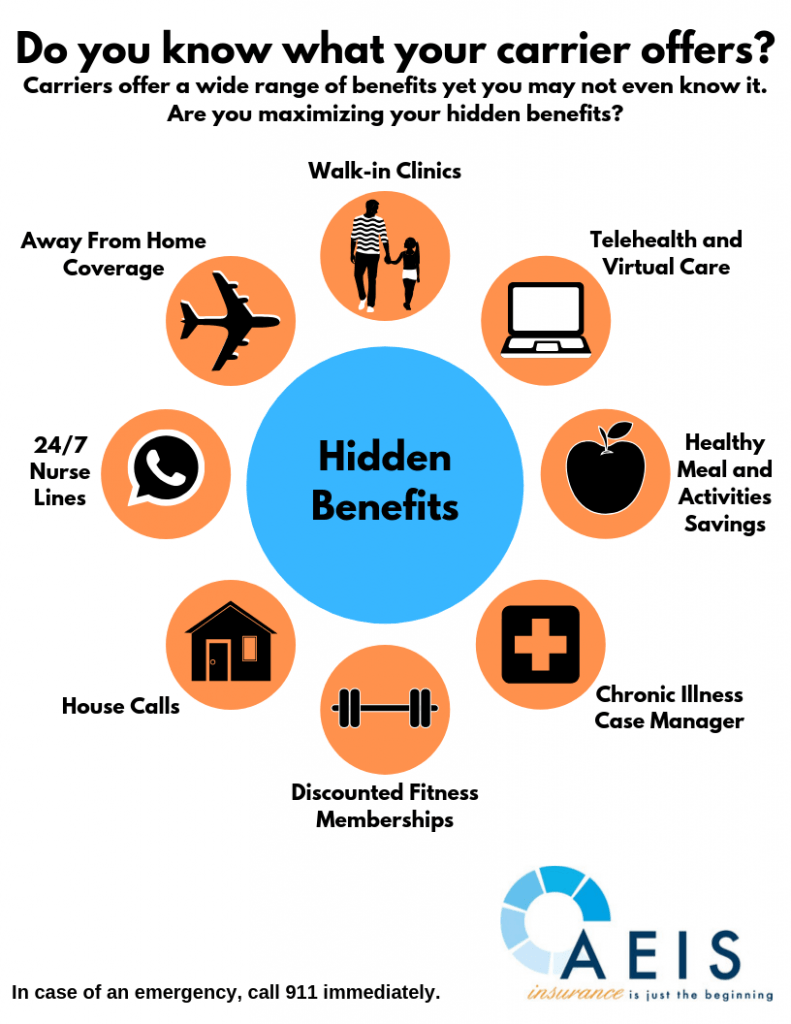

Once you have a clear image of your wellness requires, the following action is to examine the coverage alternatives readily available to you. Medical insurance strategies can differ dramatically in terms of what services they cover. Begin by reviewing the vital parts of each strategy, consisting of hospitalization, outpatient services, preventative treatment, prescription medications, and psychological wellness solutions.

It's additionally important to take into consideration the network of healthcare service providers related to each strategy. Some plans might require you to make use of certain doctors or health centers, while others offer higher versatility in choosing carriers. Pay interest to any restrictions regarding recommendations, as some strategies might demand a medical care physician's authorization to see professionals.

Compare Costs and Premiums

When reviewing medical insurance strategies, contrasting costs and expenses is an important step in making an informed choice. Premiums are the regular monthly settlements you need to make to maintain your insurance policy protection, and they can differ substantially amongst different strategies. It is important to analyze just how these premiums match your budget plan while considering your general health care demands.

In enhancement to costs, you must likewise check out other associated prices, such as deductibles, copayments, and coinsurance. A lower premium may seem attractive, but it can come with greater out-of-pocket expenses when you look for treatment. On the other hand, a strategy with a higher costs may provide lower out-of-pocket costs, making it much more affordable in the future.

Additionally, keep in mind of any concealed prices, such as annual limits or exclusions that might influence your overall costs. To make an extensive contrast, create a you can find out more spreadsheet to track the costs alongside various other costs for every plan you are considering. This well organized approach will certainly enable you to envision which plan provides the most effective worth based on your awaited healthcare usage. Ultimately, picking a health insurance coverage strategy calls for a mindful equilibrium in between price and the level of protection given.

Check copyright Networks

Evaluating the expenses and costs of medical insurance strategies is just component of the decision-making procedure; it is equally important to inspect company networks. A company network is a team of healthcare suppliers, including physicians, professionals, and hospitals, that have actually agreed to provide services at negotiated rates. Selecting a plan with a network that includes your preferred carriers can significantly influence your general health care experience.

Furthermore, recognize the sort of network connected with the strategy-- HMO, PPO, EPO, or POS-- as this will influence your flexibility in selecting companies. Strategies with even more extensive networks might supply better options however might come with higher premiums. Inevitably, comprehending provider networks guarantees you receive the required treatment while handling costs efficiently, making it an essential part in choosing the best medical insurance strategy.

Testimonial Strategy Flexibility

Understanding the adaptability of a important link medical insurance plan is critical, as it straight affects your capacity to accessibility treatment and manage your medical care requires - Health Insurance Florida. A flexible health insurance strategy allows you to make choices that align with your individual scenarios, such as selecting healthcare service providers, therapy choices, and even the timing of care

When assessing plan adaptability, take into consideration elements such as the ability to see experts without a recommendation, the incorporation of out-of-network carriers, and whether you can alter plans throughout the year if your needs develop. Some strategies may offer a broader array of solutions or alternative treatments, which can be advantageous if you have details wellness needs.

Furthermore, examine the strategy's insurance coverage for urgent and emergency care, along with its policies relating to telehealth solutions. In today's electronic age, the capacity to gain access to treatment from another location can considerably improve your healthcare experience.

Eventually, an adaptable health and wellness insurance policy strategy encourages you to make educated decisions about your treatment while accommodating modifications in your wellness and lifestyle. Cautious assessment of these aspects is necessary for selecting a strategy that ideal fits your requirements and spending plan.

Conclusion

To conclude, selecting an appropriate wellness insurance policy plan requires a detailed analysis of private health demands, insurance coverage choices, associated expenses, service provider networks, and plan flexibility. A complete understanding of these elements can significantly boost the decision-making procedure, ensuring that More Info the chosen strategy aligns with both wellness needs and economic restraints. By systematically evaluating each element, people can protect a health and wellness insurance strategy that gives appropriate protection and accessibility to required healthcare solutions.

Comprehending your wellness needs is a critical action in picking the right health and wellness insurance policy strategy.Examining the costs and costs of health insurance plans is just component of the decision-making procedure; it is similarly important to check company networks. Ultimately, understanding service provider networks guarantees you receive the needed treatment while managing costs efficiently, making it a crucial element in choosing the appropriate wellness insurance coverage plan.

In conclusion, selecting an appropriate health and wellness insurance coverage strategy demands an extensive examination of specific health needs, coverage options, associated costs, provider networks, and strategy adaptability. By methodically evaluating each facet, individuals can safeguard a health insurance plan that offers adequate protection and access to needed healthcare solutions.

Report this page